Executive Summary: From “Promises” to “Possession”

As we stand on the threshold of 2026, the narrative of Noida’s real estate market is shifting fundamentally. If 2024-25 was about speculation based on infrastructure announcements, 2026 is the year of realization.

With the Noida International Airport (Jewar) entering its final operational testing phase for a Q1 2026 commercial launch and the foundation stone for the International Film City having been laid in late 2025, the region is transitioning from an “investor market” to an “end-user market.”

This exclusive Pranshi Infra report identifies the top 10 locations that are not just “promising” but are “delivering” in 2026. We focus on areas where infrastructure is visible, minimizing execution risk while maximizing ROI. Whether you are seeking rental income from ‘BiigTech’ or capital appreciation in ‘Eternia’, this guide is your roadmap for 2026.

Market Outlook 2026: The “Delivery” Year

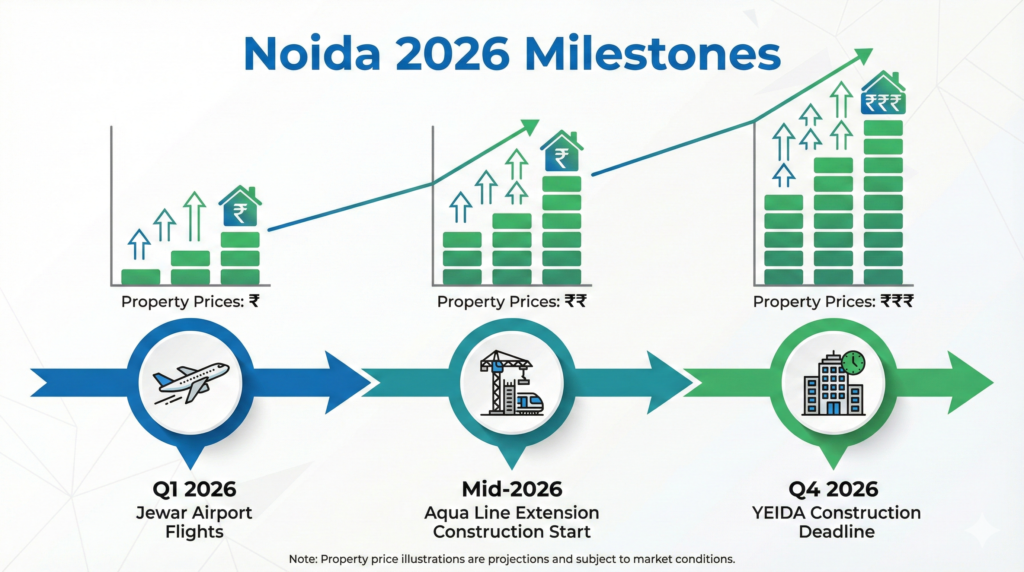

The Airport Effect: Reality Check

While the Jewar Airport saw minor timeline adjustments in late 2025, commercial operations are set to commence in early 2026. History suggests that the steepest price appreciation often occurs after the first flight takes off, as the utility value of the location becomes undeniable. Pranshi Infra predicts a secondary price surge in sectors along the Yamuna Expressway (Sector 22D) and the Noida-Greater Noida Expressway in mid-2026.

The Metro Multiplier

A major development for 2026 is the approval of the Aqua Line extension (Sector 51 to Knowledge Park V). This has instantly re-rated the potential of Greater Noida West (Tech Zone IV), turning it from a budget market into a connected premium hub.

YEIDA’s Construction Mandate

A crucial update for plot investors: YEIDA has extended the construction deadline for lease deeds to December 31, 2026. This will trigger a massive wave of construction activity in 2026, transforming “ghost sectors” into habitable neighborhoods and driving up land rates.

Top 10 Investment Locations for 2026

Location 1: Sector 150 – The “Green” Gold Standard

2026 Outlook: Sector 150 remains the undisputed king of luxury living. By 2026, many marquee projects like Godrej Palm Retreat are nearing possession or are fully operational. The focus here has shifted from “under-construction risk” to “ready-to-move premium.”

Why Invest in 2026: With Shaheed Bhagat Singh Park functional and the sports amenities live, rental demand from expats and CXOs working in the nearby corporate hubs (Sector 142/135) is peaking.

Price Projection: Stabilizing at ₹13,000–₹15,000/sq. ft., offering steady, low-risk compounding.

Location 2: Sector 146 – The “New” Sector 150

2026 Outlook: If you missed the bus on Sector 150 in 2021, Sector 146 is your 2026 opportunity. With the metro station already operational and Godrej Tropical Isle commanding premium rates , this sector is bridging the price gap rapidly.

Pranshi Infra Insight: Sector 146 offers better immediate connectivity to the Expressway than Sector 150. In 2026, as commercial sectors nearby fill up, 146 will be the preferred residence for top management professionals.

Location 3: Tech Zone IV (Greater Noida West) – The “Metro” Bet

2026 Outlook: This is the “Value Pick” of 2026. The approval of the Metro extension is the game-changer. Tech Zone IV is no longer just “affordable housing”; it is a connected urban center.

Spotlight Project: Eternia Residences: With prices still hovering below the Noida average (approx. ₹5,500 – ₹9,000/sq. ft.), Eternia offers the highest percentage appreciation potential.

Why Invest Now: You are buying at “pre-metro” prices in 2026 to sell at “post-metro” prices in 2029. It is a classic arbitrage opportunity.

Location 4: Sector 44 – The “South Delhi” Mirror

2026 Outlook: Sector 44 is immune to market fluctuations. It is the address for “Old Money” and Ultra-HNIs.

Spotlight Project: Godrej Riverine: As one of the few new luxury launches in a fully settled sector, it commands a scarcity premium.

The 2026 Driver: The continued saturation of Delhi makes Sector 44 the closest, most viable upgrade for South Delhi families looking for modern gated communities without losing connectivity.

Location 5: Sector 142 – The Connectivity Core

2026 Outlook: Sector 142 is emerging as the Central Business District (CBD) of the Expressway.

Spotlight Project: One FNG: With construction advancing rapidly, One FNG by Group 108 is set to redefine Grade-A office spaces. The operational metro station and the FNG Expressway (nearing functionality) make this the most accessible office location in NCR.

Pranshi Infra Strategy: Invest in office spaces here for long-term lease yields (7-8%) from multinational tenants.

Location 6: Sector 98 – The “Mall Mile”

2026 Outlook: Sector 98 is the face of Noida’s commercial lifestyle.

Spotlight Project: Sikka Mall of Noida (The Downtown): Approaching completion, this project is poised to capture the footfall of the entire expressway.

Why 2026 is Critical: Retail investments work best when “fit-outs” begin. As brands start taking possession in 2026, the asset value will jump from “construction-linked” to “revenue-linked.”

Location 7: Knowledge Park III – The “Yield” King

2026 Outlook: For investors seeking monthly cash flow rather than just capital gains, this is the #1 location.

Spotlight Project: BiigTech: Situated amidst universities and IT parks, BiigTech caters to a captive audience.

The 2026 Thesis: Student housing and studio apartments here are recession-proof. With colleges expanding, the demand for quality, managed accommodation (like BiigTech studios) is outstripping supply. Pranshi Infra forecasts yields of 8%+ here.

Location 8: Sector 128 – The “Golf” Belt

2026 Outlook: Sector 128 is synonymous with low-density luxury.

Spotlight Project: Max Estates 128 / Paras Avenue: While Max caters to residential needs, Paras Avenue (Sector 129, adjacent) is the high-street retail hub serving this elite catchment.

Investment Angle: This sector is for the “defensive investor” who wants asset preservation and steady growth backed by a premium pin code.

Location 9: Sector 72 – The “Interchange” Hub

2026 Outlook: Central Noida’s most critical junction (Blue Line meets Aqua Line).

Spotlight Project: M3M The Line: Offering studio apartments and retail, this project thrives on the massive daily footfall of the metro interchange.

2026 Update: With the IKEA store construction progressing nearby, the “catchment value” of Sector 72 is set to explode. It is ideal for retail investors.

Location 10: Sector 22D (Yamuna Expressway) – The “Aero” City

2026 Outlook: This is the highest beta (high risk, high reward) zone. 2026 is the year the airport actually opens.

Spotlight Projects: ACE YXP & ACE Acreville: ACE YXP is a lifestyle center designed to serve airport traffic. ACE Acreville offers plotted developments.

Pranshi Infra Verdict: The window for “cheap” entry here is closing. Once the first commercial flight lands in 2026, prices in Sector 22D will decouple from the rest of the market.

Pranshi Infra: Strategic Portfolio Recommendations for 2026

At Pranshi Infra, we customize portfolios based on your financial goals. Here is how we are structuring investments for our clients in 2026:

| Investor Goal | Recommended Location | Top Pick Project | Why? |

|---|---|---|---|

| High Growth (3-5 Years) | Tech Zone IV (Gr. Noida West) | Eternia Residences | Metro approval will drive massive appreciation. |

| Immediate Rental Income | Knowledge Park III | BiigTech | Steady student/IT demand ensures 8%+ yield. |

| Capital Safety & Status | Sector 44 | Godrej Riverine | Scarcity of land in Central Noida ensures value hold. |

| Commercial Cash Flow | Sector 98 | Sikka Mall of Noida | High-visibility retail on Expressway nearing delivery. |

| The "Jackpot" Bet | Yamuna Expressway (Sec 22D) | ACE YXP / Plots | Airport opening in 2026 is the ultimate trigger. |

Conclusion: The “Wait and Watch” Era is Over

In 2025, many investors waited for the airport to open or the metro to be approved. Now, in 2026, those events are happening. The “uncertainty discount” is gone, which means prices are firming up.

The smart money in 2026 is moving into execution-stage assets—projects that are visible, funded, and nearing delivery. Whether you choose the stability of Sector 150, the income potential of BiigTech, or the growth of Eternia, the cost of inaction in 2026 will be higher than ever.

Secure your 2026 Portfolio with Pranshi Infra. Visit us: https://pranshiinfra.in/ Call: +91 78388 99990