The Strategic Real Estate Evolution of the Yamuna Expressway: A Comprehensive Analysis of the Top 10 Investment Destinations for 2025 and Beyond

The Yamuna Expressway, a 165-kilometer access-controlled concrete artery connecting Greater Noida with the historic city of Agra, has evolved from a transportation infrastructure project into the most significant economic corridor in Northern India. This transformation is driven by the visionary planning of the Yamuna Expressway Industrial Development Authority (YEIDA) under the Master Plan 2041, which envisions a self-sustaining urban ecosystem where industrial precision, residential comfort, and commercial vitality converge. At the heart of this metamorphosis is the Noida International Airport at Jewar, an infrastructure catalyst that is fundamentally recalibrating property values and investor expectations across the Delhi-NCR region. For investors navigating this complex landscape, Pranshi Infra Advisor Pvt. Ltd. emerges as the quintessential strategic partner, offering a synthesis of market transparency, legal compliance, and wealth-building advisory services.

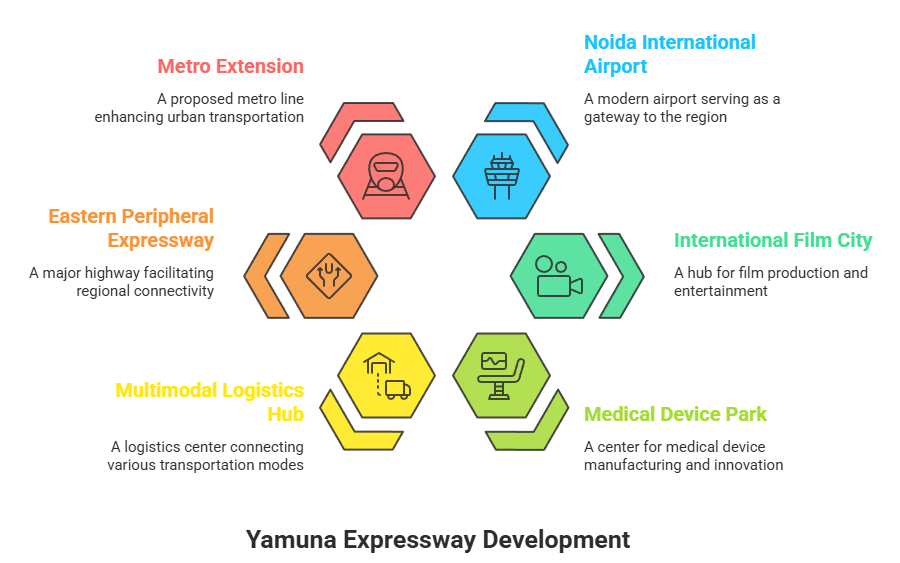

The economic narrative of the corridor is defined by unparalleled capital appreciation. Historical data indicates that while traditional real estate markets in the National Capital Region (NCR) experienced periods of stagnation, the Yamuna Expressway region witnessed a five-fold jump in land prices over a five-year period. Plot values surged by an extraordinary 536%, rising from an average of ₹1,650 per square foot in 2020 to approximately ₹10,500 per square foot by 2025. This growth is not merely speculative but is anchored in the physical delivery of large-scale projects like the Medical Device Park, the International Film City, and the Multimodal Logistics Hub. Pranshi Infra, led by CEO Pratap Singh Ahlawat, positions itself as a “Strategic Wealth Partner,” guiding clients toward high-yield opportunities that are secured by RERA approvals and YEIDA’s institutional framework.

The Macroeconomic Catalysts: Assessing the Global Aerotropolis Potential

The development of the Yamuna Expressway follows the “Aerotropolis” model, a concept where an airport serves as the urban center, surrounded by clusters of aviation-linked businesses and residential townships. This model has historically driven immense wealth creation in global cities like Dubai, Singapore, and Memphis. The Noida International Airport (NIA) at Jewar, scheduled for its commercial launch in late 2025, is the primary engine of this growth. The airport is projected to handle 12 million passengers annually in its first phase, with a master plan that contemplates six runways and a final capacity exceeding 70 million passengers.

The following table contextualizes the price appreciation trajectory driven by these infrastructure milestones:

| Year | Avg. Plot Price (₹/sq. ft) | Avg. Apartment Price (₹/sq. ft) | Infrastructure Milestone |

|---|---|---|---|

| 2020 | 1,650 | 3,950 | Land Acquisition for NIA Phase 1 |

| 2021 | 2,700 | 4,150 | NIA Groundbreaking Ceremony |

| 2022 | 4,150 | 5,200 | Film City Bid Finalization |

| 2023 | 5,700 | 6,700 | Medical Device Park Allotments |

| 2024 | 9,350 | 9,600 | Flight Calibration Tests at NIA |

| 2025 | 10,500 | 10,200 | NIA Operationalization (Target) |

This exponential growth curve highlights the “early-mover advantage” that Pranshi Infra helps its clients capitalize upon. By identifying sectors that are currently in the infrastructure-delivery phase, the firm ensures that investors enter the market before the next wave of appreciation triggered by the airport’s first commercial flight.

The Top 10 Investment Destinations Near Yamuna Expressway

The selection of the top 10 locations is based on a multi-dimensional analysis of connectivity, proximity to anchor projects, current civil work progress, and projected rental yields. Pranshi Infra focuses on these specific zones to provide clients with a diversified portfolio ranging from residential plots to commercial studio apartments.

1. Sector 18: The Residential Benchmark

Sector 18 is widely regarded as the most premium destination for residential plotted developments along the expressway. Governed by YEIDA, this sector consists of thousands of plots ranging from 300 to 4,000 square meters. It is strategically positioned within the “Golden Zone” near the Jewar Airport, making it a primary choice for high-net-worth individuals and long-term investors.

The sector is divided into several pockets, with Pocket J and Pocket I being the most developed. These pockets feature 24-meter and 45-meter wide internal roads, completed sewerage systems, and electrification. Market data shows that plots in Sector 18 have seen their values multiply as possession was granted to allottees. For instance, the original allotment rate of ₹4,750 per square meter in 2009 has given way to market resale prices ranging from ₹65,000 to ₹85,000 per square meter by 2025. Pranshi Infra facilitates seamless transactions in this sector, helping clients navigate the transfer and registry process while ensuring all legal documentation is verified against YEIDA records.

2. Sector 20: The Hub of Strategic Expansion

Directly adjacent to Sector 18, Sector 20 offers a similar plotted development model but with a larger emphasis on mixed-use potential. It is one of the largest residential sectors under the YEIDA jurisdiction, designed to accommodate a blend of high-end villas and institutional facilities. The sector benefits from its proximity to the proposed 100-meter and 120-meter wide arterial roads that connect the residential core to the commercial and industrial zones.

Sector 20’s investment appeal was highlighted by the massive response to the 2024 YEIDA residential scheme, where over 1 lakh applicants competed for a limited number of plots. This high demand-to-supply ratio ensures robust liquidity for investors. Pranshi Infra provides deep insights into the specific pockets of Sector 20 that are closest to the upcoming metro link, which is expected to connect Pari Chowk to the Yamuna Expressway sectors.

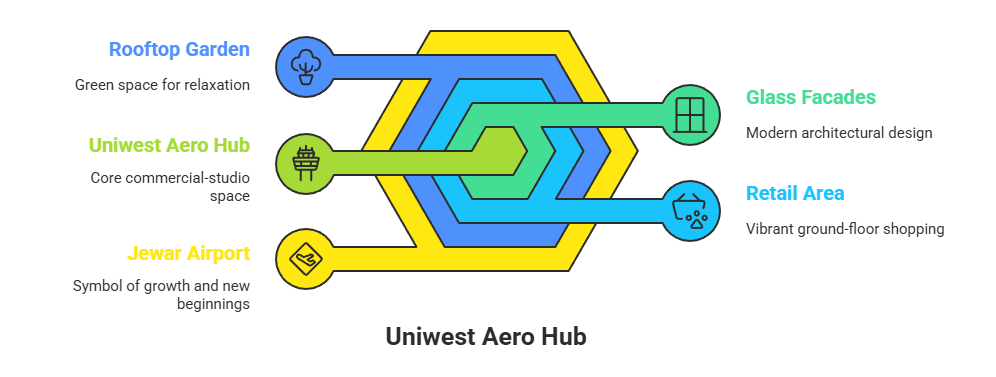

3. Sector 22D: The Commercial and Multi-Story Epicenter

Sector 22D has emerged as the most dynamic sector for mid-to-high segment apartment projects and visionary commercial developments. It is strategically located near the expressway loop, providing unparalleled access to the airport (approximately a 10-minute drive) and the Buddh International Circuit.

Pranshi Infra specifically highlights Uniwest Aero Hub in this sector as a prime commercial opportunity. This RERA-approved project (UPRERAPRJ621735/05/2025) offers a blend of commercial shops, food courts, and transit-friendly studio apartments. With an expected possession date in May 2025, it aligns perfectly with the airport’s launch, ensuring high rental demand from airport staff, travelers, and corporate professionals.24 Additionally, the sector hosts the Ace YXP project, which integrates shopping malls, food courts, and multiplexes, creating a self-sustaining lifestyle hub.

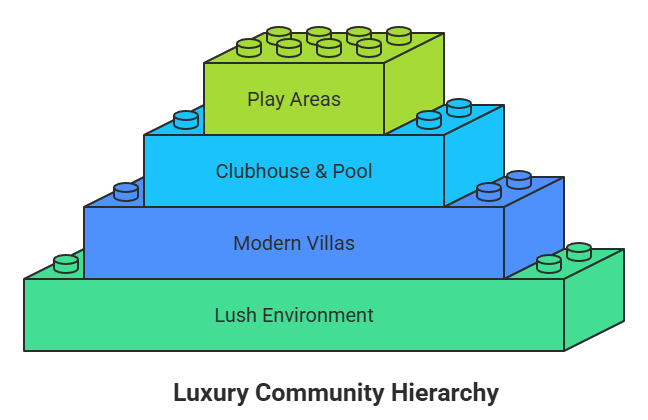

4. Sector 22A: The Gated Township Frontier

Sector 22A represents the evolution of luxury living on the Yamuna Expressway, characterized by large-scale gated townships that offer global standard amenities. Pranshi Infra focuses on ACE Acreville, a premium residential plotted development spread over 100 acres. This project is designed for those seeking a sophisticated lifestyle, offering plots ranging from 1,800 to 4,500 square feet and luxury 3/4 BHK villas.

The sector is positioned as a “Wellness Hub,” featuring projects like Ace Verde and Nimbus The Palm Village, which offer studio apartments and premium residences surrounded by landscaped gardens, yoga centers, and meditation pods.25 The presence of high-end infrastructure, such as 24/7 CCTV surveillance and wide internal roads, makes Sector 22A a preferred choice for the NRI (Non-Resident Indian) segment and corporate executives.

5. Sector 17A: The Knowledge and Institutional Hub

The value of real estate is often tethered to the presence of educational infrastructure, which ensures a steady influx of residents and high rental demand. Sector 17A is designed as an institutional hub, already hosting premier universities such as Gautam Buddha University, Noida International University, and Galgotias University.

The concentration of students and faculty creates a massive requirement for studio apartments and service suites. Pranshi Infra advises investors to look at Sector 17A for consistent rental yields, which are projected to be in the range of 4-6%.5 Furthermore, YEIDA has recently auctioned 15 institutional plots for schools and colleges in this sector, ensuring its long-term status as Northern India’s “Knowledge City”.

6. Sector 21: The International Film City Nexus

The proposed International Film City in Sector 21, spanning over 1,000 acres, is set to be one of Asia’s largest media and entertainment hubs. This project is not just a landmark but a major employment generator, expected to attract production houses, post-production studios, and tourism-related businesses.

Real estate in the sectors surrounding Sector 21 is poised for a significant “Entertainment Premium.” The development of a 30-km Yamuna riverfront and a 100-foot Lord Krishna statue nearby will further enhance the region’s profile as a tourism destination. Pranshi Infra helps clients identify residential and commercial assets that will cater to the high-income creative professionals relocating to this hub.

7. Sector 28: The Industrial and Technological Backbone

Sector 28 is the location of the Medical Device Park, a flagship initiative under the “Make in India” program spread across 350 acres. As North India’s first dedicated medical manufacturing cluster, it has already seen the allotment of plots to over 100 companies specializing in radiology, oncology, and orthopedic implants.

Industrial sectors like Sector 28 act as a stabilize force for the real estate market. The demand for housing from the thousands of engineers and specialized workers employed here will directly impact the appreciation of residential plots in the neighboring Sectors 18 and 20. Pranshi Infra focuses on this sector for industrial land consulting and for identifying commercial plots that will serve as logistics nodes for the manufacturing units.

8. Sectors 32 and 33: The Manufacturing and Toy Park Clusters

Sectors 32 and 33 are dedicated to industrial diversification, hosting specialized zones like the Toy Park and manufacturing units for global giants like Vivo and Patanjali.4 These sectors are characterized by large-scale plots and specialized infrastructure for heavy industrial traffic.

The growth of Sectors 32 and 33 ensures that the Yamuna Expressway is not just a bedroom community for Noida but a thriving industrial center. Investors who purchase commercial or residential land near these sectors benefit from the “Corporate Spillover,” where businesses require local offices, staff housing, and warehousing facilities.

9. Tappal-Bajna: The Multimodal Logistics Gateway

Located near the intersection of the Yamuna Expressway and the Eastern Peripheral Expressway, Tappal-Bajna is being developed as a Multimodal Logistics Park (MMLP). Spanning approximately 950 hectares, this hub will feature truck terminals, rail sidings, and state-of-the-art warehousing.

Tappal offers an “Early Entry” opportunity for investors looking for massive land parcels at prices lower than the core YEIDA sectors. Pranshi Infra provides advisory services for land acquisition in this zone, emphasizing its potential to become the primary logistics gateway for North India’s trade. The proximity to the airport’s cargo terminal ensures that Tappal will be the center of aviation-linked logistics.

10. Raya (Mathura): The Heritage City and Tourism Expansion

The Raya Urban Centre, integrated with the Heritage City project, is a visionary expansion toward Mathura and Vrindavan. This 9,350-hectare development will focus on spiritual tourism, featuring a heritage-themed township, wellness centers, and artisanal markets.

Pranshi Infra identifies this location as the “Next Destination” for hospitality and vacation home investments. The direct connectivity provided by a proposed 7-km expressway link to the Banke Bihari Temple ensures that Raya will witness a high volume of pilgrim footfall, driving the demand for hotels, service apartments, and premium second homes.

Legal and Financial Readiness: The Path to Secure Investment

Investing in the Yamuna Expressway corridor requires a rigorous approach to documentation and financial planning. Pranshi Infra serves as a “Trusted Advisor” in ensuring that all transactions meet the legal standards set by YEIDA and RERA.

Checklist for Secure Investment

YEIDA Approval: Verify that the plot or project is part of a YEIDA-notified sector and has the necessary clearance from the authority.

RERA Registration: Ensure the project has a valid RERA number (e.g., UPRERAPRJ248777 for ACE Acreville) to guarantee construction timelines and financial transparency.

Circle Rates vs. Market Rates: Understand the difference between the government-mandated circle rate (currently ₹35,000 per sqm in Sector 18) and the prevailing market resale rates to calculate stamp duty and registration costs accurately.

Possession and Registry Status: For plots, verify if the “Lease Deed” has been executed. Pranshi Infra assists in checking if the plot is “Registered” or “Unregistered” in the resale market, which significantly impacts the transaction process.

Financial Support and Incentives

The Uttar Pradesh government has introduced various incentives to boost the region’s attractiveness. This includes a 100% stamp-duty waiver for certain industrial units and subsidized land for educational institutions. Pranshi Infra helps residential buyers identify bank-approved projects, facilitating easier home loan approvals and competitive interest rates.

Future Outlook: The 2030-2041 Vision

The long-term outlook for the Yamuna Expressway is defined by the YEIDA Master Plan 2041, which aims to develop the region as a “Globally Recognized City”. The plan focuses on high-quality, sustainable infrastructure, including “Smart Villages,” dedicated cycle tracks, and a “Metro Neo” system for seamless internal mobility.

As the airport enters its subsequent phases of expansion and the Film City project takes physical shape, the micro-markets closest to these hubs are expected to undergo a second wave of rapid appreciation. The transition from an “Investment-first” market to an “End-user” market will be completed by 2030, as professionals relocate to the region for high-value jobs in aviation, manufacturing, and media.

Conclusion: Partnering with Pranshi Infra for Strategic Wealth Creation

The Yamuna Expressway represents a once-in-a-generation real estate opportunity. With its five-fold appreciation in the last five years and a multi-decadal growth plan in place, it is the most promising corridor for investors seeking to build lasting wealth. However, the complexity of the market—ranging from industrial zones to heritage expansions—requires an expert hand to navigate.

Pranshi Infra Advisor Pvt. Ltd. offers the expertise, project access, and ethical commitment required to succeed in this landscape. By focusing on the top 10 locations identified in this report and leveraging the firm’s strategic insights, investors can secure high-performing assets that are aligned with India’s future infrastructure milestones. Whether you are an individual seeking a dream villa in ACE Acreville, a corporate entity looking for commercial space in Uniwest Aero Hub, or a long-term investor eyeing a plot in Sector 18, Pranshi Infra is your bridge to a sustainable and profitable future. The window of opportunity is wide, but as the 2025 airport launch approaches, the time to move from planning to action is now. Contact Pranshi Infra today to begin your strategic journey on the Yamuna Expressway.